Economic Fallout Grows with New Car Import Duties

By Oshadhi Gimesha, Lead Journalist | Editor-in-Chief Approved

Auto Market Shaken

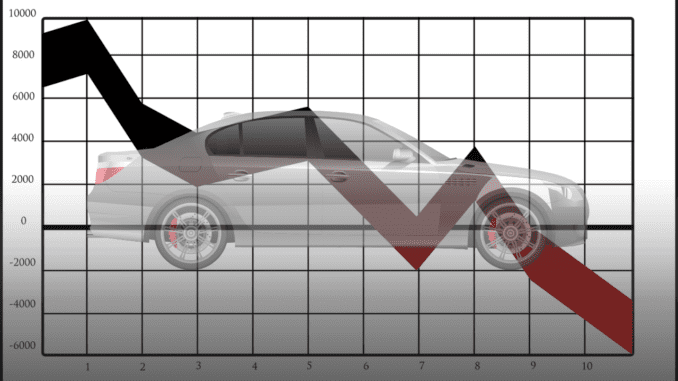

Asian auto stocks took a hit for the second day in a row on March 28, 2025, as investors reacted to U.S. President Donald Trump’s tariffs on car imports. The new duties, set to start on April 2, 2025, target vehicles and parts not made in the U.S. For American and global readers, this signals rising costs and trade tensions that could reshape the auto industry.

Key Points

- Asian auto stocks fell on March 28, 2025, with Toyota down 4.29% and Honda down 4.24%.

- Trump’s tariffs on car imports, effective April 2, 2025, target vehicles and parts like engines.

- Analysts say that prices for imported cars in the U.S. could rise from $5,000 to $15,000.

Trade Tariffs Hit Hard

On March 28, 2025, Asian auto stocks extended their decline as Trump’s tariffs on car imports rattled investors. Japanese automakers felt the brunt, with Toyota dropping 4.29% and Honda falling 4.24%. Nissan, which has three plants in Mexico, saw a 1.63% decline. Mazda Motor lost 3.99%, and Mitsubishi Motor fell 1.27%. South Korea’s Kia Motors, with a plant in Mexico, traded 2.66% lower, while Hyundai Motor dropped 3.53%. Chinese electric vehicle maker Nio saw its shares in Hong Kong fall 7.83%. Xpeng and Li Auto slipped 0.57% and 0.78%, respectively. The White House confirmed the tariffs, effective April 2, 2025, will target imported passenger vehicles, light trucks, and key parts like engines and transmissions.

Analysts predict significant price hikes for U.S. buyers. Imported cars could cost $5,000 to $15,000 more, according to Goldman Sachs. Even locally made vehicles might see prices rise by up to $8,000. More than 90% of U.S. motor vehicle imports come from five trading partners: the EU, Canada, Mexico, South Korea, and Japan. The tariffs aim to protect U.S. manufacturing, but they’re sparking fears of a broader trade war. The EU, Canada, and other partners have signaled plans to retaliate, raising concerns about a prolonged conflict. Trump has also threatened “far larger” tariffs if Canada and the EU team up against the U.S.

Challenges in Implementation

🔔 Never Miss a News Report – Join Our Discord!

The tariffs, starting April 2, 2025, come with complexities. A political consultancy noted the challenge of applying duties to auto parts. Under the U.S.-Mexico-Canada Agreement, importers can certify their U.S. content to avoid the full 25% tariff. The tariff will only apply to the value of non-U.S. content, but a method to calculate this is still being developed. This process involves the Commerce Secretary and the Customs Service, which could delay full implementation. For now, USMCA-eligible auto parts are exempt from the 25% tariff until the system is in place.

Economic Ripple Effects

The decline in Asian auto stocks on March 28, 2025, reflects broader economic worries. Higher car prices could strain U.S. consumers, especially with costs potentially rising by $15,000 for imports. The tariffs could hurt profits in Japan and South Korea, where automakers rely on U.S. sales. Germany and Canada, also major U.S. exporters, might face similar challenges. A trade war could disrupt global supply chains, affecting jobs and businesses worldwide. The UK and the Netherlands, with ties to the EU auto market, could see indirect impacts. Australia, navigating its trade dynamics, watches closely. If tensions ease by June 1, 2025, markets might stabilize. But if a trade war escalates, economic strain could deepen by January 1, 2026.

Market Outlook Ahead

If the U.S. and its partners negotiate by June 1, 2025, the auto industry might avoid a full trade war, stabilizing by 2026. But if tariffs lead to retaliation, costs could soar. For U.S. and global readers: support domestic manufacturing or push for open trade? France, Australia, and others are watching closely. The auto market’s future hangs in the balance. News Zier will keep tracking this story as it develops.

All facts are independently verified, and our reporting is driven by accuracy, transparency, and integrity. Any opinions expressed belong solely to the author. Learn more about our commitment to responsible journalism in our Editorial Policy.