By Oshadhi Gimesha, Lead Journalist | Editor-in-Chief Approved

A Steady Hand in Shaky Times

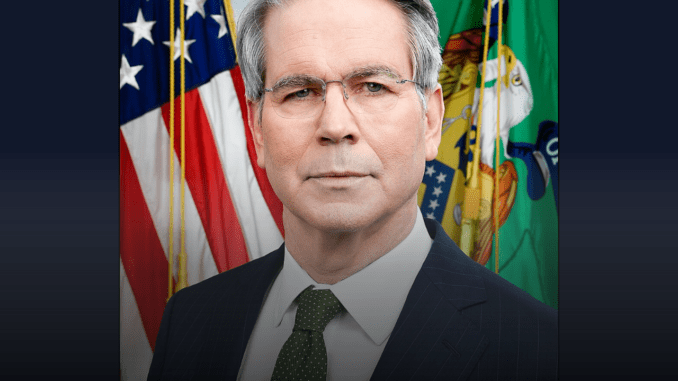

Treasury Secretary Scott Bessent dropped a bold claim today, March 16, 2025: The White House is steering the U.S. away from a financial cliff. Speaking Sunday, he painted a picture of an economy teetering but not tumbling, thanks to Trump’s team. For Americans rattled by wild markets and tariff talks, it’s a reassuring nod, though not everyone’s buying the calm. With stocks swinging and deficits looming, Bessent’s words aim to steady nerves at home and abroad.

Key Points

- Bessent says the White House moves are averting a financial crisis.

- Markets stay volatile, with the Dow down 7% in the past month.

- Trump’s tariffs and spending cuts stir hope and doubt alike.

The View From the Top

Bessent laid it out plain on Sunday: the U.S. isn’t barreling toward disaster. “We’re heading off a financial crisis,” he said, pointing to the administration’s grip on what he calls a wobbly inherited economy. The Dow lost 7% last month, and unemployment ticked up to 4.1% in February with just 151,000 jobs added—below expectations. Still, Bessent sees light. “We’re shifting from government splurge to private growth,” he argued, framing it as a detox, not a crash. For U.S. families, it’s a lifeline to cling to amid the chaos.

Across the Atlantic, Germans or Brits might raise an eyebrow; market dips hit there, too. In Canada, tied tight to U.S. trade, it’s a wait-and-see game. Bessent’s pitch? The White House has a plan: tariffs to jolt trade, spending cuts to trim fat, and a focus on the “real economy” over Wall Street jitters. “Volatility’s just noise,” he’s said before. But can it hold?

Our Administration and the American people are focused on the real economy, not fake news polling or “vibecessions.”

— Secretary of Treasury Scott Bessent (@SecScottBessent) March 16, 2025

After four disastrous years for families and workers, President Trump has the track record and vision to deliver the most vibrant economy and capital markets in… pic.twitter.com/Z3hdg5Wp39

What’s Driving the Edge?

This isn’t a random boast. Trump’s crew inherited a budget bleeding $840 billion in four months—6% of GDP, a peacetime oddity. Bessent blames years of “unsustainable” spending, with the national debt past $36 trillion. Then there’s the tariff saga: 25% on Canada and Mexico (now softened with exemptions), 20% on China, and a 200% threat looming over EU booze. Markets hate uncertainty, stocks yo-yoed again today. Yet February’s flat wholesale inflation and a slight consumer price dip offer Bessent ammo: “Maybe inflation’s taming.”

The flip side’s real, though. Economists warn tariffs could hike prices, not just tweak them, especially if Canada or China dig in. Australia and the Netherlands, trade-sensitive, know this dance, retaliation’s a risk. Bessent counters with oil prices and mortgage rates dropping since January, claiming Trump’s policies deserve a nod. “We’re not getting credit,” he grumbled. For families like the Wilsons in Ohio, where gas bills eased, it’s a faint silver lining.

Calm or Calm Before the Storm?

Bessent’s betting on a soft landing. “This isn’t a recession,” he stressed Thursday, pushing a “smooth transition” from public to private jobs. Think laid-off feds finding factory gigs, not chaos. Big banks might cheer—less red tape, more lending room. But for folks like Sarah Wilson, a Cleveland cashier, it’s less rosy. “Cheaper gas helps, but my groceries aren’t budging,” she says. Surveys echo her: 49% see the economy worsening, up from last month.

In France or the UK, where deficits spark protests, Bessent’s optimism might sound naive. Critics argue that slashing spending while tariffs rile trade could stall growth, not spark it. The $131.4 billion trade gap in January, up 34%, nags at the “America First” fix. Bessent shrugs it off: tariffs are leverage, not poison. Still, if April’s broader levies hit, the jury’s out on who pays.

What’s Next for Your Wallet?

If Bessent’s right, stability’s around the bend—tariffs settle, private jobs bloom, and markets calm. He’s banking on Trump’s April moves to force trade wins without breaking the bank. For U.S. households, it’s a tense wait: Will costs ease or climb? Canada and Germany watch too—trade ripples don’t stop at borders. This isn’t a quick fix; it’s a high-stakes pivot. News Zier will keep you posted as the stakes unfold.

All facts are independently verified, and our reporting is driven by accuracy, transparency, and integrity. Any opinions expressed belong solely to the author. Learn more about our commitment to responsible journalism in our Editorial Policy.